Fixed-income update: Bonds reclaim role as a volatility buffer

High-quality bonds are an important portfolio diversifier in uncertain markets.

Global capital markets have seen a noticeable shift in expectations this year. Although backward-looking economic fundamentals still look solid — unemployment is low, inflation has moderated and corporate fundamentals are generally strong — investors are feeling more cautious. The optimism that peaked following the U.S. election has given way to concerns over downside risks to growth. Markets have responded to this shift with equities struggling, credit spreads widening and Treasury yields falling.

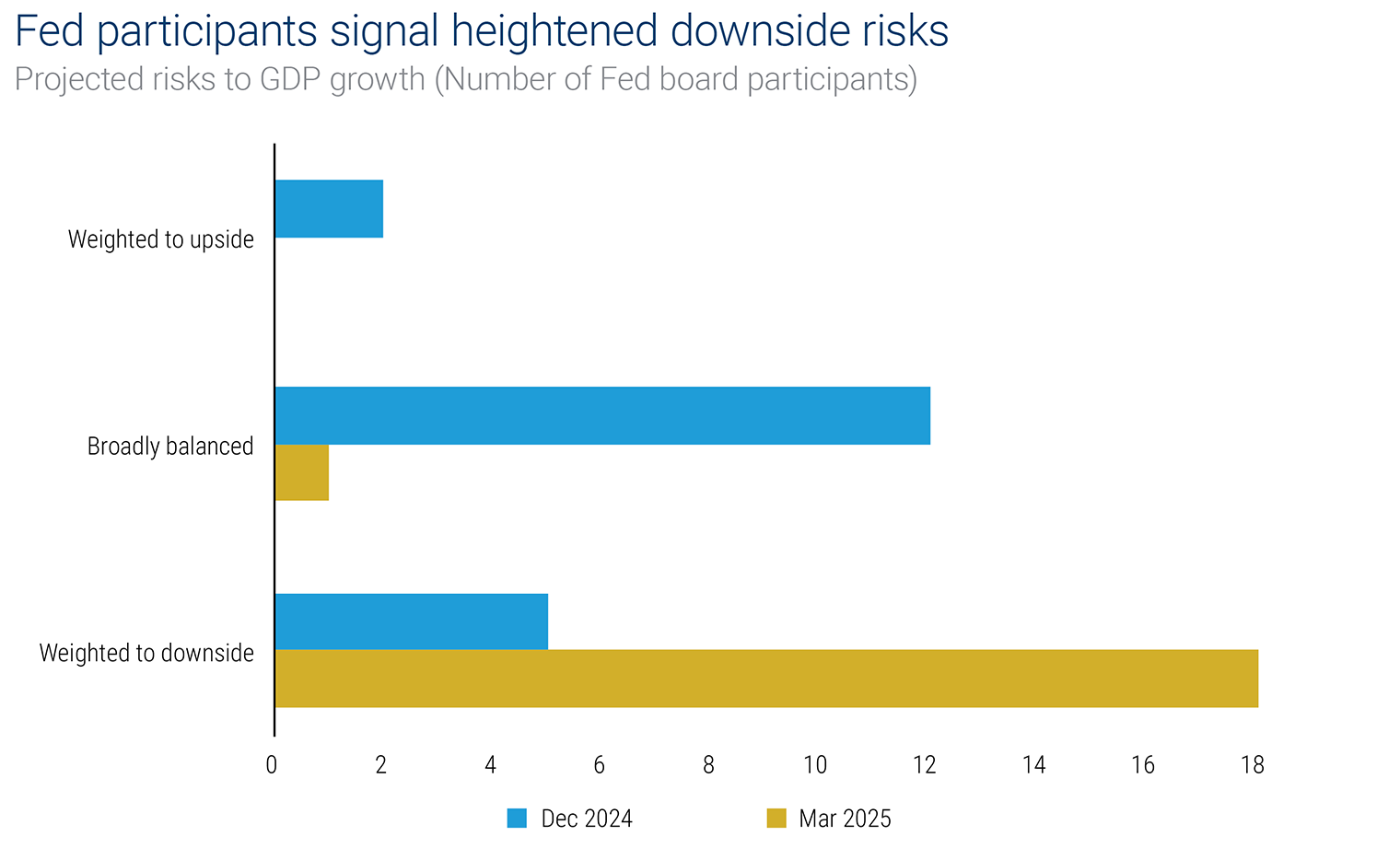

Entering 2025, investors expected pro-growth policies (deregulation and tax cuts) to take center stage. Instead, the focus has been on tariffs and tighter immigration policies — both of which could weigh on growth. The Federal Reserve (Fed) has also acknowledged that risks are skewing to the downside.

As investors grapple with these challenges, fixed income has regained its traditional role as an effective portfolio diversifier. In this environment, a focus on high-quality bonds and selective credit exposure is essential.

Several factors have shaped bond market performance so far this year:

So far this year, credit has underperformed duration. Despite this weakness, credit markets have remained orderly, with buyers stepping in to capitalize on improved valuations. Today’s modestly wider spreads reflect lower Treasury yields rather than outright weakness in corporate bond prices. As expected in this environment, high-quality fixed-rate debt has outperformed high-yield, bank loans and other floating-rate instruments. Overall, however, credit is still fairly expensive by historical standards.

A surprising source of outperformance, relative to expectations at the beginning of 2025, has been emerging markets. Investors in emerging market debt have already navigated similar tariff policies during the previous Trump administration, and risk premiums were built in last fall. Importantly, tariff discussions have been equally focused on developed market trading partners like Europe and Canada, as they have been on emerging market economies like China and Mexico.

The Fed held rates steady at its latest meeting but announced a slowdown in the pace of its quantitative tightening program. This suggests a subtle shift toward easing, even if rate cuts aren’t imminent.

The Fed faces a tricky balancing act. Tariffs could push inflation higher, but they could also hurt growth by reducing consumer spending and business investment. This interplay adds another layer of complexity to the Fed’s decision-making process.

The Fed has indicated that it remains open to cutting rates twice this year. Before committing to a path, it will likely need to see clearer signs of how the potential tug of war between rising inflation and weakening demand will play out.

As credit spreads have widened, pockets of opportunity have emerged in sectors with less exposure to trade and growth risks. Security selection will be important here, as certain industries — such as autos and building materials — face greater pressure from tariffs and supply chain disruptions, while others, like chemicals and some consumer sectors, may hold up better. We think dispersion within the high-yield market is likely to grow, and credit selection will be a significant driver of returns.

One of the key themes this year is the return of fixed income as a portfolio diversifier. Unlike recent years, when bonds struggled to provide downside protection, high-quality fixed income has reasserted its role as a volatility buffer. With equity markets facing ongoing uncertainty, this dynamic is likely to remain in focus.

Investors should be prepared for a fluid economic outlook as the year unfolds. Growth concerns are rising, policy uncertainty remains high and the Fed’s next moves will be closely scrutinized. In this environment, a nuanced, diversified approach to portfolio construction will be essential.

There are risks associated with fixed-income investments, including credit risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer term securities.

Columbia Management Investment Advisers, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be appropriate for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that any forecasts are accurate.

@2025 Columbia Threadneedle. All rights reserved.

CTBPY1Y (04/25) CTNA7800454.2

Sign up to have the latest insights delivered straight to your inbox.

There are risks associated with fixed-income investments, including credit risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer term securities.